Ephemera

Ottoman Bank photos

The Ottoman Bank known from 1863 to 1925 as the Imperial Ottoman Banks was a bank that played a major role in the financial history of the Ottoman Empire. By the early 20th century, it was the dominant bank in the Ottoman Empire, and one of the largest in the world.

It was founded in 1856 as a British institution chartered in London, and reorganized in 1863 as a French–British venture with head office in Constantinople, on a principle of strict equality between British and French stakeholders. It soon became dominated by French interests, however, primarily because of the greater success of its offerings among French savers than British ones. In its early years, the bank was principally a lender to the Ottoman government with a monopoly on banknote issuance and other public-interest roles, including all treasury operations of the Ottoman state under an agreement ratified in February 1875 that was however never fully implemented. In the 1890s, it pivoted to a greater emphasis on commercial and investment banking, which it developed with lasting success despite a serious crisis in 1895.

Following World War I, the Banque de Paris et des Pays-Bas (known since the 1980s as Paribas) took control of the bank, and renamed it Ottoman Bank in 1925. The bank’s remaining public-interest privileges and monopolies were phased out. Its operations outside Turkey were gradually dismantled, a process that was completed in 1975.

During the Crimean War that started in October 1853, France and Great Britain were allied in support of the Ottoman Empire. In 1855, the two nations sent a joint mission to assess Ottoman finances, led by Alexandre de Plœuc for France and Augustus Edward Hobart-Hampden for the UK, who would later become respectively the first and second General Managers of the Imperial Ottoman Bank in Constantinople.

The Ottoman Bank had modest beginnings with six staff in Constantinople (12 in 1858) and four in Smyrna as well as a branch office in Khan Antoun Bey, then the main building in the Beirut Souks. It also had a branch in Galaţi in Moldavia, complemented by Bucharest in Wallachia from 1861. The bank made some poor credit allocation decisions, suffered from the 1860 civil conflict in Mount Lebanon and a financial crisis in 1861, and met hostility from the Galata bankers

The early activity of the BIO was mostly about providing financing to the Ottoman government, even though as early as August 1865 the bank’s staff was concerned about the creditworthiness of its main debtor, and the bank was by no means the only player on that market.

In 1864, the bank opened a branch in Salonica, the main Ottoman port city where it was not already present, and another one in the Cypriot port city of Larnaca. In November 1865, however, the shareholders rejected plans for more ambitious branch network expansion. In October 1867, the bank opened a branch in Alexandria, its first in the Khedivate of Egypt. In 1868, a commercial branch was opened in Paris.

The Ottoman state’s continued financial challenges led successive grand viziers Mehmed Rushdi Pasha and Hüseyin Avni Pasha to seek an expansion of the role of the bank by making it the operator of all imperial treasury operations, including all revenue collection, expenditures, and short-term funding, with the aim to restore confidence in the state’s financial discipline and thus improve its access to credit. The Porte sent senior official Mehmed Sadık Pasha to Paris to negotiate the new convention in April 1874, and the text was promptly signed there on 18 May 1874. It stipulated that the bank would operate the Ottoman treasury in all provinces where it had a branch, and would open new branches where it was not already present. The bank would receive a fee of 0.75 percent on all government financial transactions, and 1 percent on short-term government debt issuance. The creation of new branches was a generally loss-making proposition for the bank and consequently fell well short of the convention’s stated ambitions, with only three new locations opened in 1875 in Bursa, Edirne and Ruscuk plus a sub-office of the Beirut branch in Damascus.

During the 1880s, 1890s and 1900s, the bank kept its dominant role in orchestrating the financing of the Ottoman government, but reduced the exposures it retained on its own balance sheet. In 1886, it agreed on a restructuring of its outstanding loans to the government. It subsequently restarted short-term lending to the Ottoman treasury, but attempted to limit the corresponding amounts, which generated serious friction with the Government.

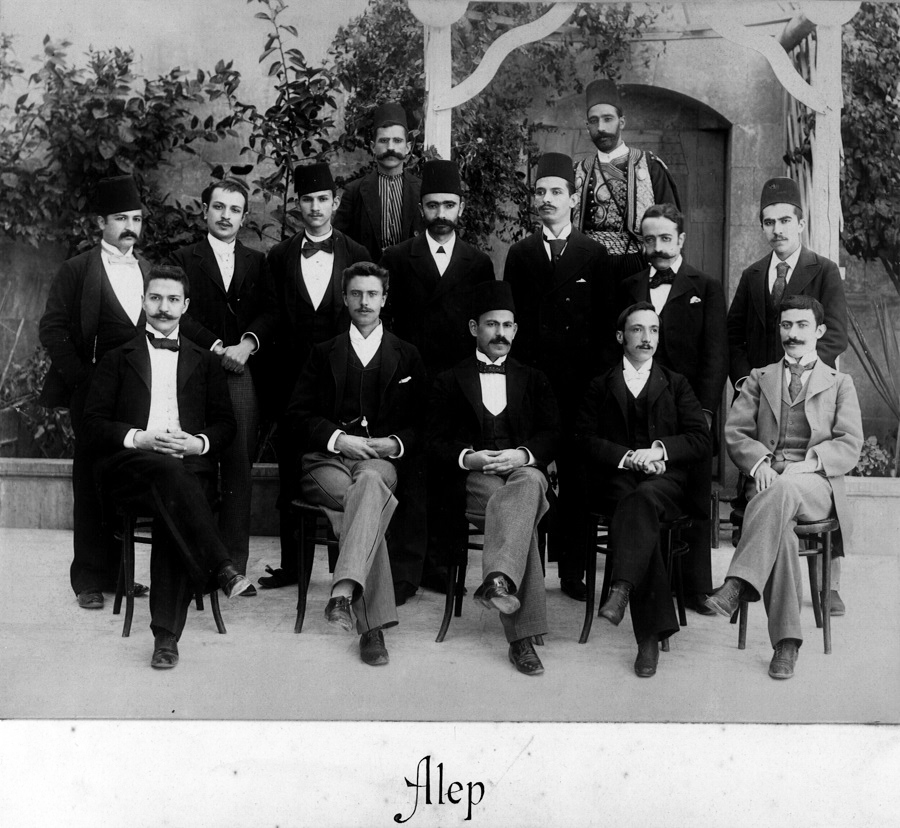

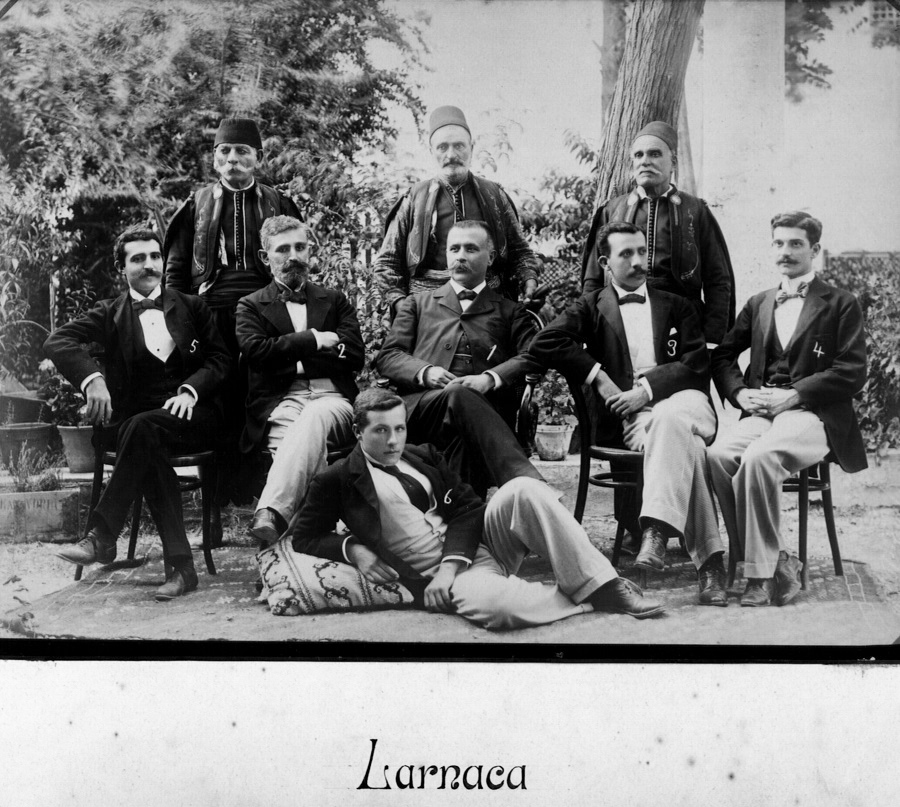

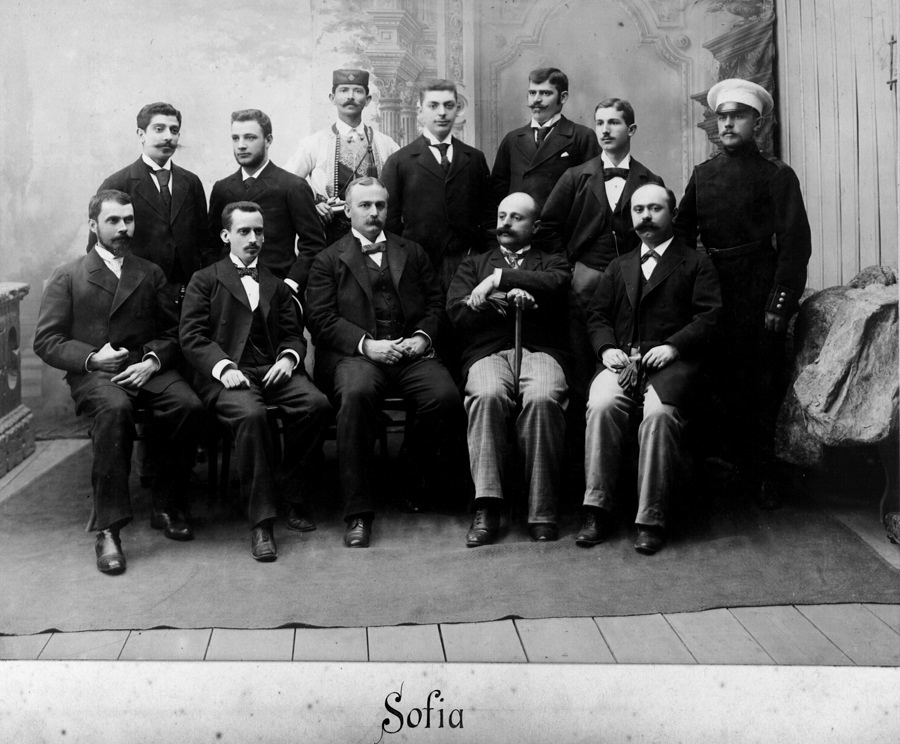

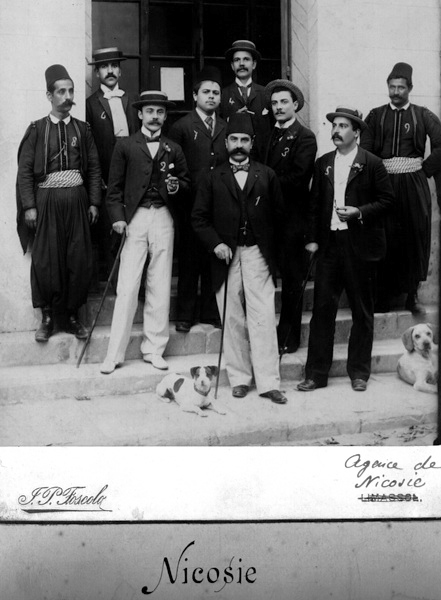

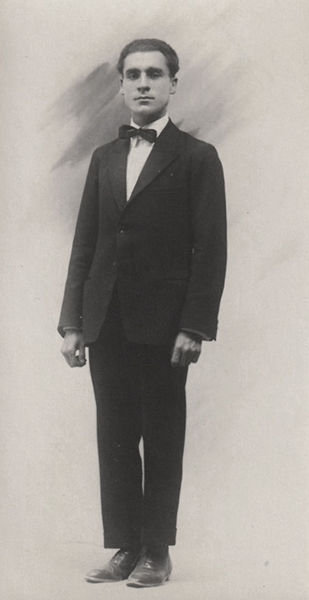

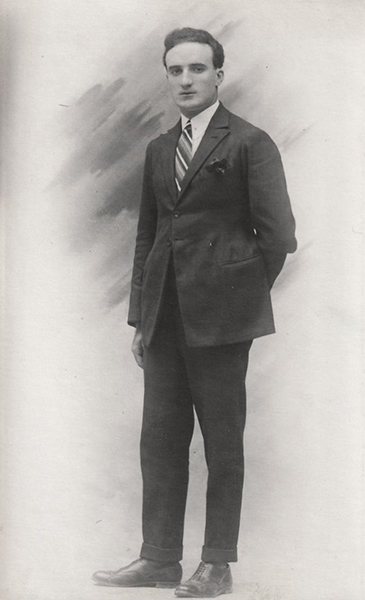

Throughout most of its history the Ottoman bank particularly in middle management had a fair sprinkling of Levantines and other minorities working and this gallery is partly to help name some of the faces in this group photographs.

Photo on the personnel card of Alida Toulon from 1924 - information on file: born in 1903, Catholic, French citizen, worked in 1924 at the Head Office of the Ottoman Bank - image courtesy of Salt Research, Ottoman Bank Archive.

Photo on the personnel card of Herbert Pisani from 1912 - information on file: born in 1889, Catholic, British citizen, worked between 1911 and 1919 at the Head Office and Stamboul Branch - image courtesy of Salt Research, Ottoman Bank Archive.

Photo on the personnel card of Winifred Ireland - information on file: born in 1896, Protestant, British citizen, worked between 1919 and 1925 at the Head Office - image courtesy of Salt Research, Ottoman Bank Archive.

Photo on the personnel card of Valentine Haydoux - information on file: born in 1904, Catholic, Hungarian citizen, worked between 1926 and 1929 at the Head Office - image courtesy of Salt Research, Ottoman Bank Archive.

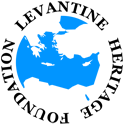

Pair of group photos of staff at Smyrna / Izmir branch of Ottoman Bank, 1895 - no names identified - image courtesy of Salt Research, Ottoman Bank Archive.

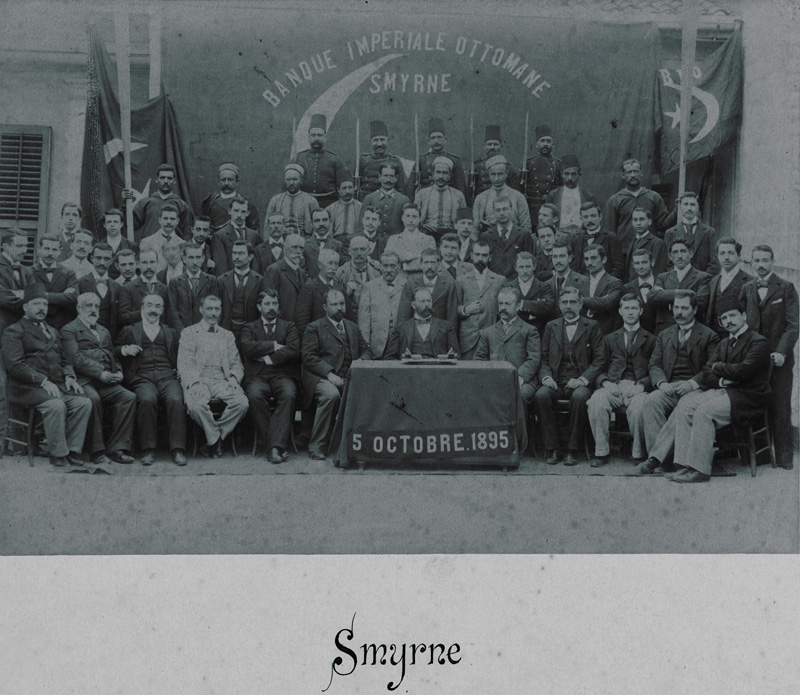

Group photo of staff at Uşak branch of Ottoman Bank, 1895 - image courtesy of Salt Research, Ottoman Bank Archive.

Group photo of staff at Mersin branch of Ottoman Bank, 1895 - image courtesy of Salt Research, Ottoman Bank Archive.

Group photo of staff at Aleppo branch of Ottoman Bank, 1895.

Group photo of staff at Larnaca branch of Ottoman Bank, 1895 - image courtesy of Salt Research, Ottoman Bank Archive.

Group photo of staff at Sophia branch of Ottoman Bank, 1895 - image courtesy of Salt Research, Ottoman Bank Archive.

Group photo of staff at Nicosia branch of Ottoman Bank, 1895 - image courtesy of Salt Research, Ottoman Bank Archive.

Individual photos of staff at Alexandria, Egypt branch of Ottoman Bank, 1923, with names on their back indicating probable local Italian (G. Lorenzo) and Jewish employees (J. Cohen, M. Samuel, D. Mizrahi) - images courtesy of Salt Research, Ottoman Bank Archive.

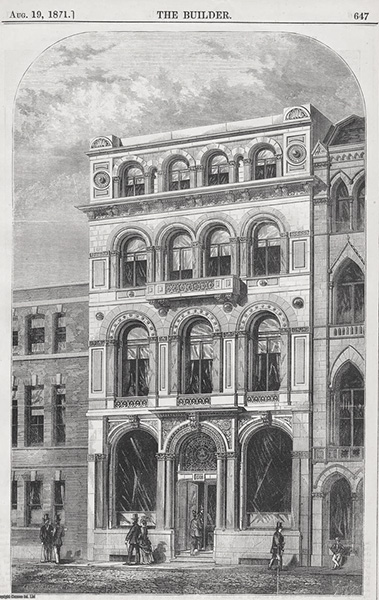

The London seat of the Ottoman Bank from 1872 to 1947, 26 Throgmorton Street designed by architect William Burnet.

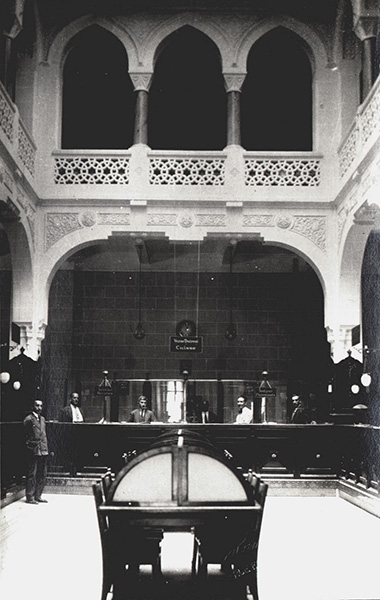

The Salonica branch of the Ottoman bank, opened 1864 - images courtesy of Salt Research, Ottoman Bank Archive.

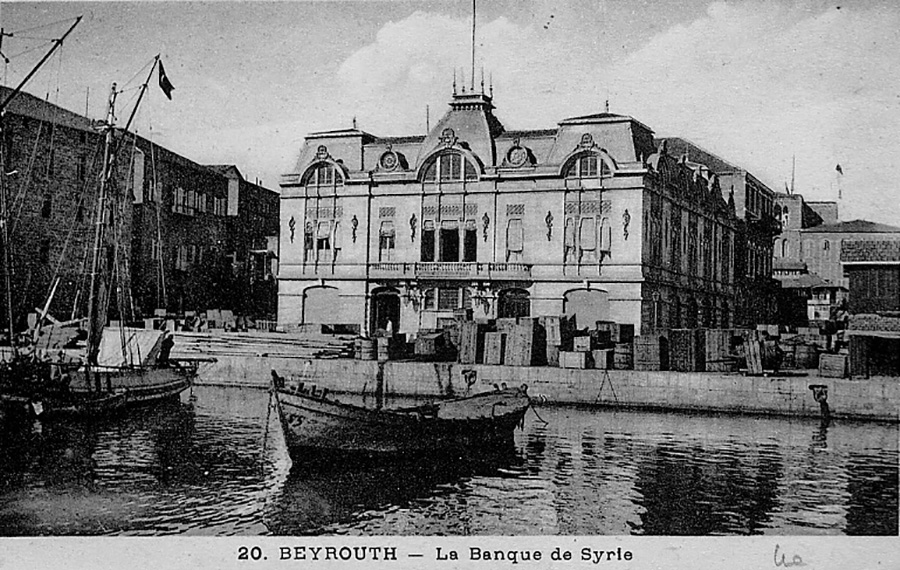

The Beirut branch of the Ottoman bank, opened 1875 - images courtesy of Salt Research, Ottoman Bank Archive.

The Nazilli branch of the Ottoman bank, opened 1881 - image courtesy of Salt Research, Ottoman Bank Archive.

The Kavala branch of the Ottoman bank, opened 1904, photographed 1930 - image courtesy of Salt Research, Ottoman Bank Archive.

The Mersin branch of the Ottoman bank, opened 1892, photographed 1930 - image courtesy of Salt Research, Ottoman Bank Archive.

The Samsun branch of the Ottoman bank, opened 1891 - image courtesy of Salt Research, Ottoman Bank Archive.

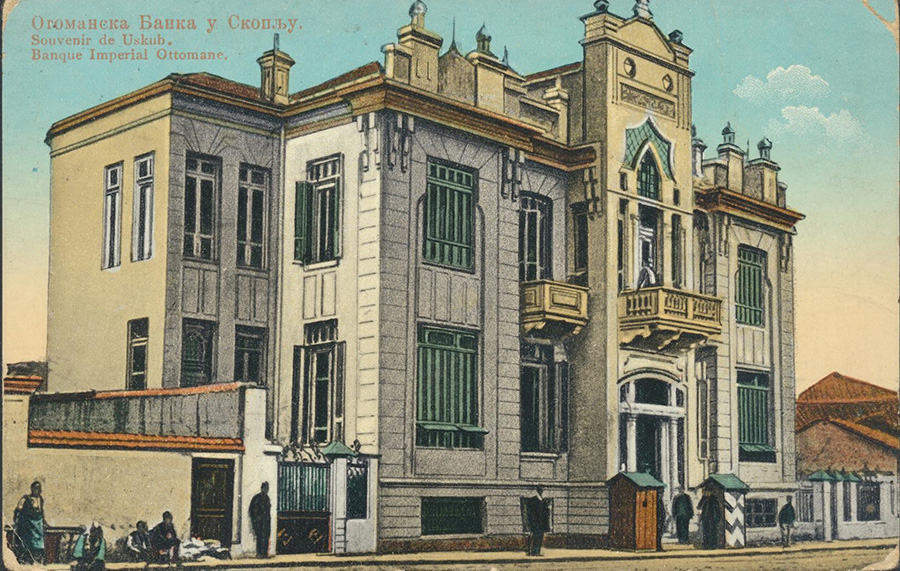

The Skopje branch of the Ottoman bank, opened 1903.

The Smyrna branch of the Ottoman bank, opened 1856, the current building dates from 1928. - images courtesy of Salt Research, Ottoman Bank Archive.

The Pera / Beyoglu branch of the Ottoman bank, opened 1891, photographed 1930 - images courtesy of Salt Research, Ottoman Bank Archive.

Group of Ottoman Bank staff in Pera - image courtesy of Salt Research, Ottoman Bank Archive.

Group of Ottoman Bank (Galata branch) staff in the 1930s in Istanbul, sitting on the left, Emilia Saridaki, and sitting on the right, Mme Nazif, wife of the ‘sous-directeur’. The husband of Emilia, Alphonse Saridaki (1879 - 1943 - with moustache) is standing at the centre of the group, by Mrs Nazif.